6 Great Benefits of Hiring Financial Planning Services

Growing a business is easy when using financial planning services, so why haven’t you invested in them? Financial planning services revolve around helping a business grow and improve its cash flow. Unfortunately, many owners avoid investing in them because they don’t want to spend money. If you avoid them, you’ll miss out on the opportunity to grow quickly.

The reason why both small and large businesses should invest in planned financial services is to reduce expenses and earn more. While they’ll require you to spend some money upfront, you can expect to make major returns on your investment.

Read on to learn more about the benefits of implementing financial planning services!

Proactive Service

One of the main benefits of hiring planned financial services is being able to receive proactive service. When a financial advisor offers proactive service, it means they’ll continue working on tasks. They won’t have to keep asking you for instructions.

Proactive service is essential when it comes to financial planning and analysis. It ensures that you have the necessary info at all times. Without it, you’ll spend a lot of time telling people what to do when you could be doing other things.

Receive Advice

Financial planning services are designed to provide business owners with the best advice to help them grow. Advice will vary depending on the size of your business and your goals. However, you can expect to get recommendations that’ll move your business forward.

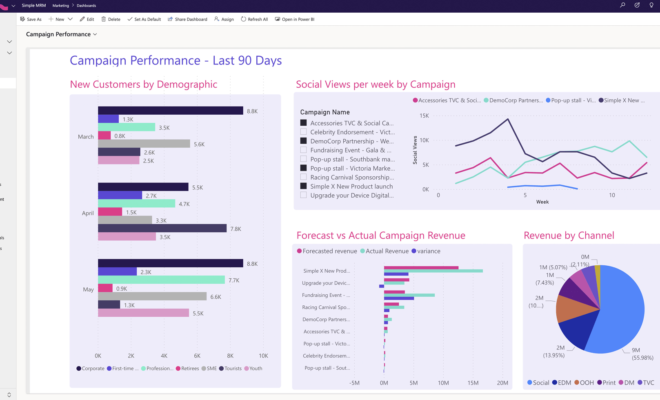

For example, a financial planning company can look at your quarterly earnings to determine what can be changed to earn more. By working with all the teams within your business, they can help you put together a plan to reduce expenses, satisfy customers, and earn more money.

Focus on Your Business’s Core

When a business owner gets interested in financial planning services, they often ask, “what does a financial advisor do?” A financial advisor is essentially someone that overlooks the finance side of your company. By analyzing your income and expenses, they can help you make better decisions.

What makes a financial advisor a good investment is being able to focus on your business’s core. This is something that many owners struggle with. If you outsource financial planning services, they can manage anything finance-related.

Doing this will prevent you from spending too much time figuring out what should be done to improve your business. You’ll also save money because you won’t have to hire various teams to help you with finances. Instead, everything can be done within an outsourced company.

Improve Collaboration

Collaboration is another thing that owners struggle with. This involves implementing a variety of things to ensure employees can work together. Investing in financial planning services can help you improve collaboration. They’ll work with your entire company, so you can boost productivity and get things done quicker.

To properly come up with budgets and plans, you must gather information from each department. Planned financial services will reach out to various teams and ask for ideas while gathering info.

While you can invest in various bookkeeping and tax accountant services, it’s best to hire one company that’ll do everything. This will ensure that your company can collaborate with another company without getting things mixed up.

Avoid Biased Decisions

When making financial decisions, an owner must choose what’s best for their company. While many owners think they know what’s best, they often make biased decisions that can negatively affect the business.

For example, an owner of a clothing business can stop offering a certain product simply because they don’t like it. If the product sells well, they’d end up missing out on profits because of their bias.

If you work with a financial advisor, you can avoid making biased decisions because you’ll get input from someone else. They can look at your business from an outside perspective that makes it easier to come up with good decisions.

Having them analyze your business and its finances will also give you more time to do other things. Whenever you must decide something, they’ll present you with different outcomes to help you.

Positive Return on Investment

Out of all the things you can invest in, a financial planning service provides one of the best return on investments (ROI). Not only can you earn more money with financial planning services, but you can also reduce how much your business spends.

Financial planning and analysis are all about figuring out what can be done with the money your business has. When hiring a financial advisor, they’ll avoid borrowing money and overspending so that your business doesn’t get stuck in a hole.

They’ll also help your business earn more money much quicker than you could alone. While you can spend time researching the market, they’ll have a ton of experience with various types of companies.

Many services specialize in certain industries, so you can expect to gain a plethora of info about what competitors are doing. This will help you put together a financial services business plan to profit as much as possible.

Hire Financial Planning Services Today

Now that you have a better understanding of what financial planning services are, we encourage you to look into them as soon as possible. The quicker you hire them, the easier it’ll be to improve your business.

Keep in mind that when looking for financial planning services, you should find a company that knows about your industry. While a basic financial advisor can help you with many things, doing this will ensure you get the best assistance.

Browse our other articles to learn more about growing a business!